12 Q

9th - 12th

16 Q

12th

5 Q

12th

17 Q

12th

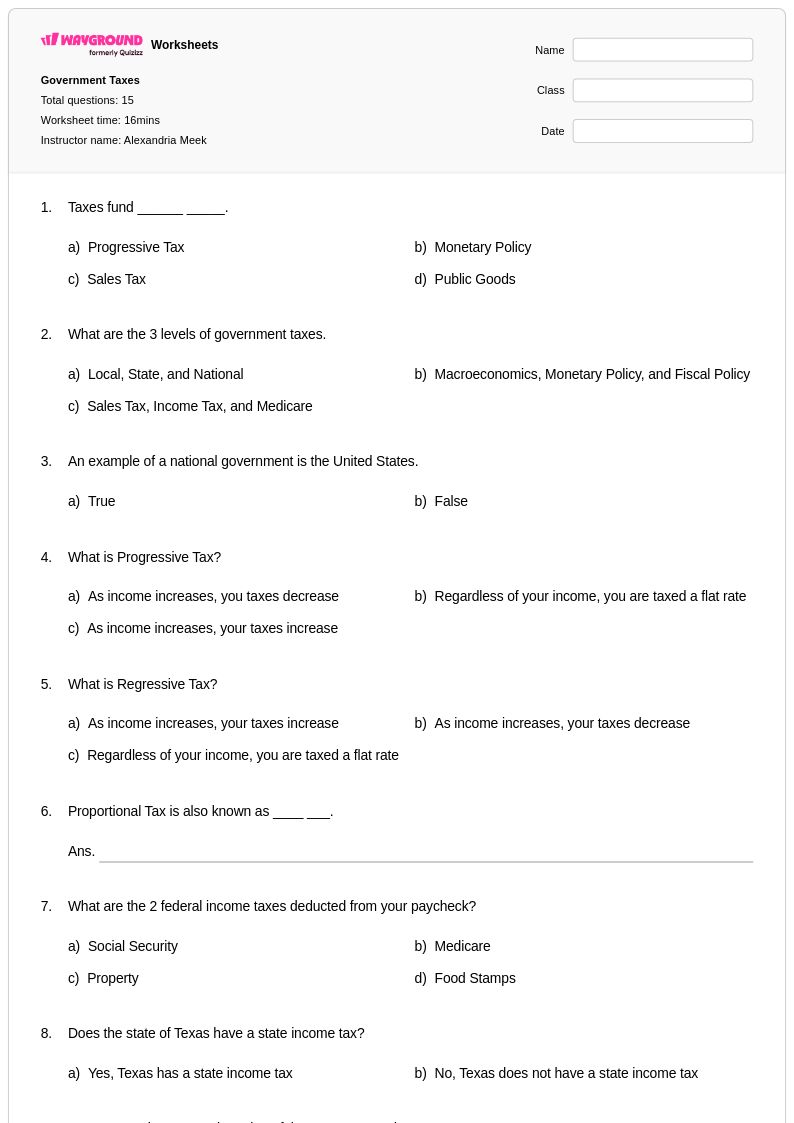

15 Q

11th

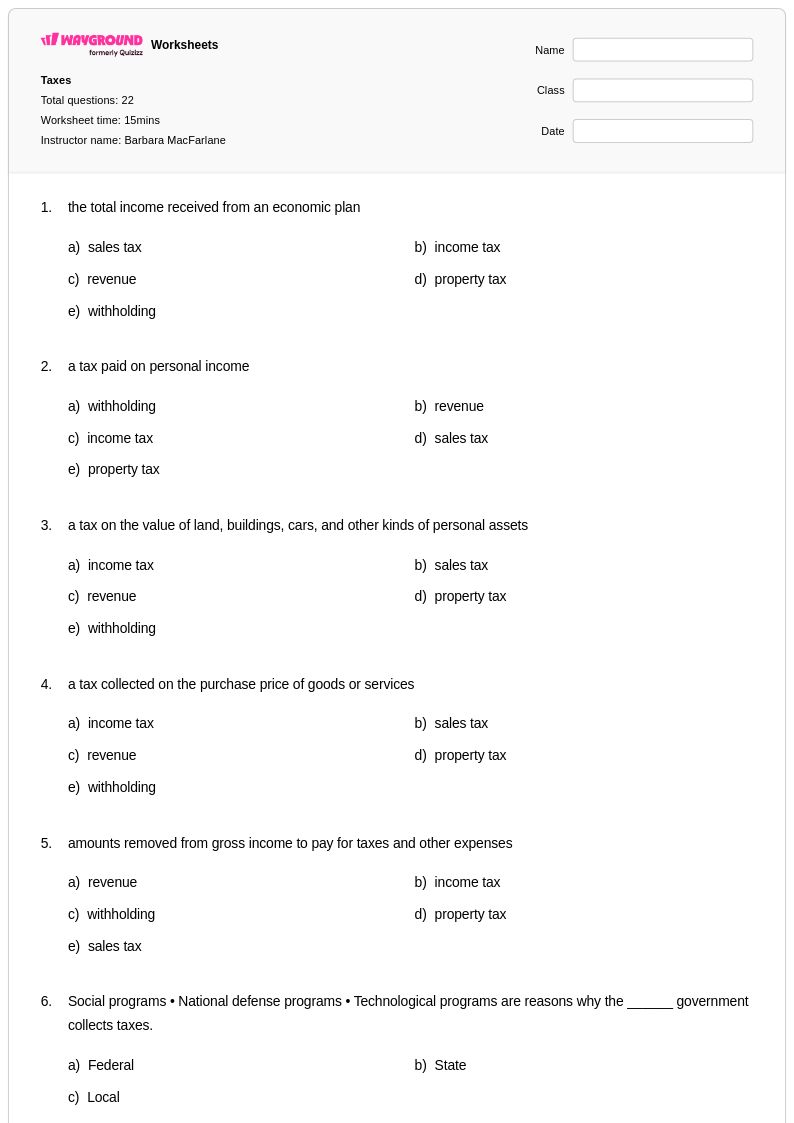

22 Q

12th

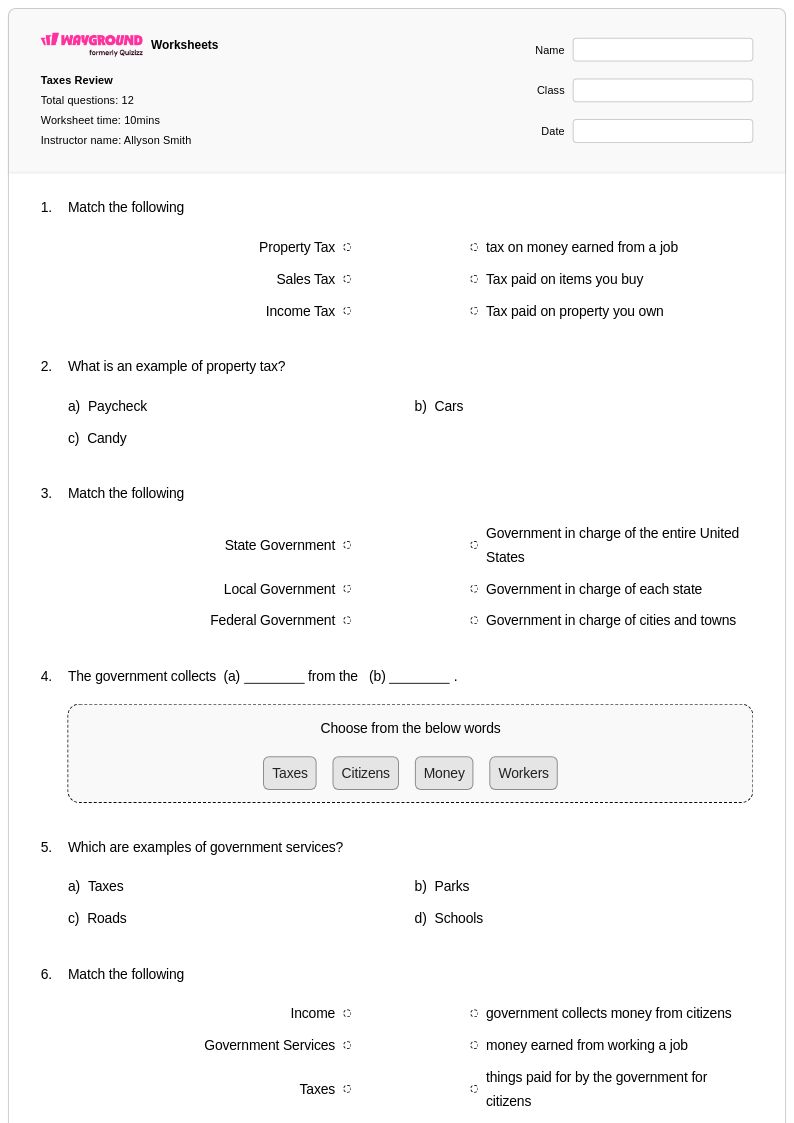

12 Q

1st - 5th

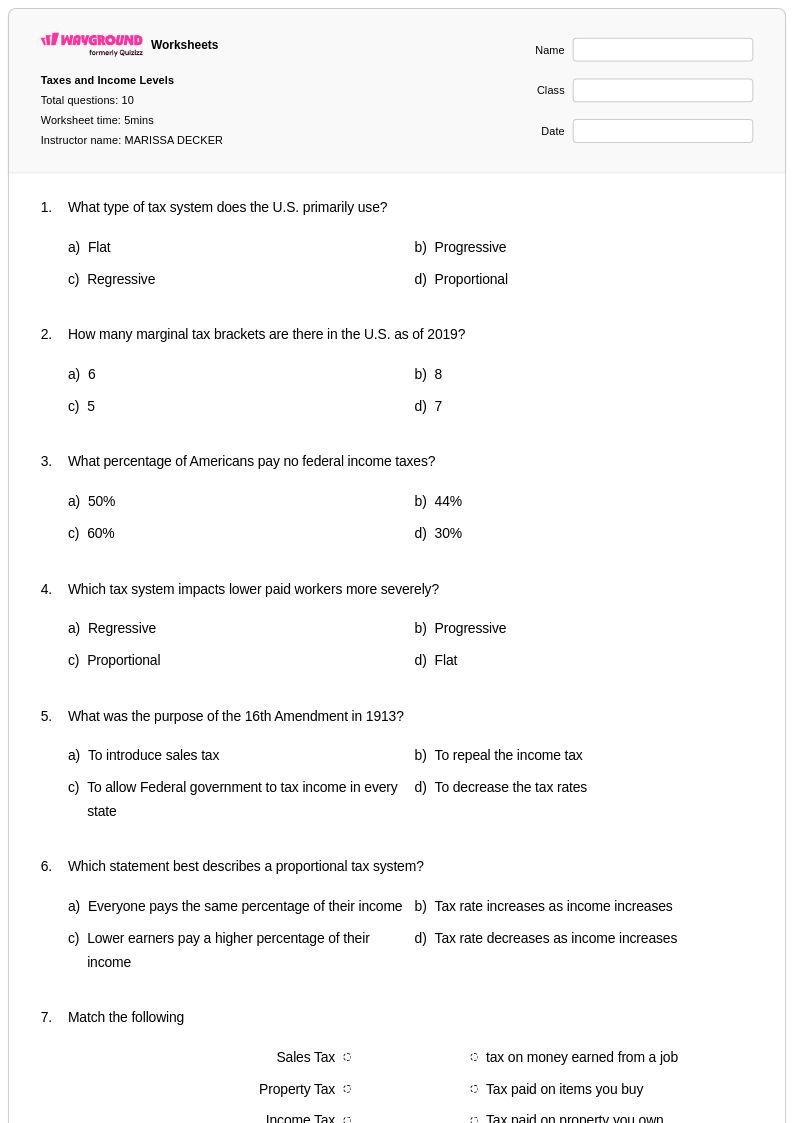

10 Q

12th

10 Q

9th - 12th

18 Q

9th - 12th

20 Q

12th

110 Q

12th

37 Q

12th - Uni

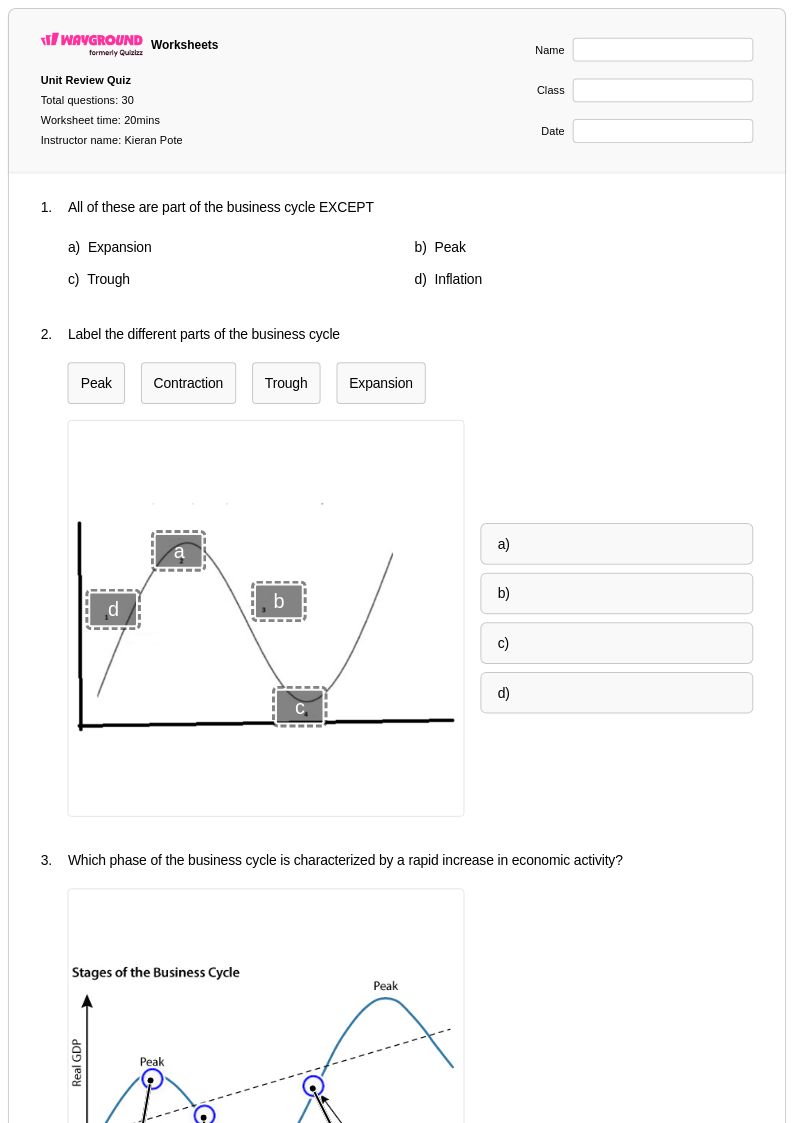

30 Q

12th

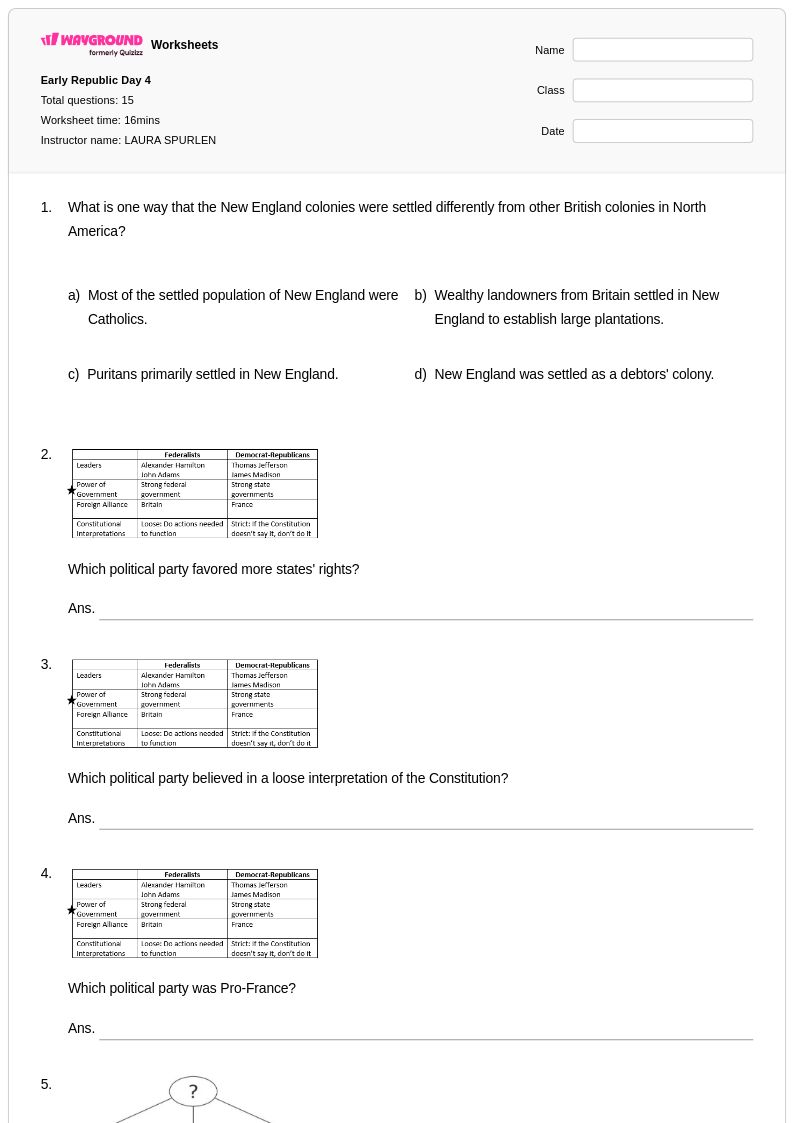

15 Q

8th

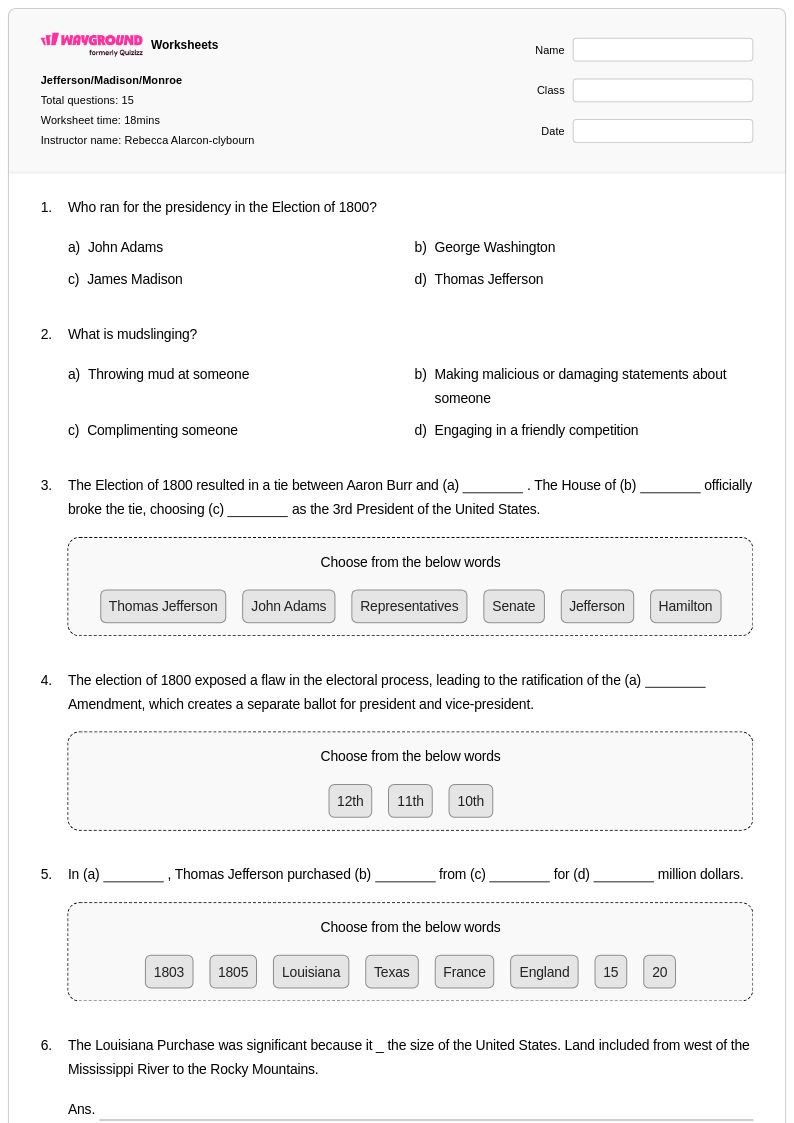

15 Q

8th

14 Q

10th

13 Q

11th

8 Q

4th

17 Q

7th

21 Q

12th

17 Q

8th

9 Q

7th

Explore Worksheets by Subjects

Explore printable Federal Tax worksheets

Federal tax worksheets available through Wayground (formerly Quizizz) provide comprehensive educational resources designed to help students understand the complexities of the United States federal taxation system. These carefully crafted materials strengthen critical thinking skills by guiding students through essential concepts including income tax brackets, tax deductions and credits, filing requirements, and the relationship between federal taxes and government services. The worksheets feature practice problems that simulate real-world tax scenarios, enabling students to apply theoretical knowledge to practical situations. Each worksheet collection includes detailed answer keys that support both independent learning and classroom instruction, while the free printable format ensures accessibility for diverse educational environments. These pdf resources effectively bridge the gap between abstract economic principles and tangible civic responsibilities that students will encounter as future taxpayers.

Wayground (formerly Quizizz) empowers educators with an extensive library of millions of teacher-created federal tax worksheets that can be easily discovered through robust search and filtering capabilities. The platform's standards-aligned content supports differentiated instruction by offering materials at various complexity levels, allowing teachers to customize resources for remediation, enrichment, or targeted skill practice based on individual student needs. Teachers benefit from flexible formatting options that include both digital and printable pdf versions, facilitating seamless integration into traditional classroom settings or remote learning environments. The comprehensive collection enables efficient lesson planning by providing ready-to-use materials that cover fundamental federal tax concepts while supporting assessment and progress monitoring. This wealth of customizable resources helps educators address diverse learning styles and academic levels while ensuring students develop essential financial literacy skills required for informed citizenship.