10 Q

9th - 12th

11 Q

3rd

5 Q

Uni

15 Q

12th

18 Q

7th

10 Q

6th

15 Q

12th

50 Q

11th - Uni

18 Q

12th

20 Q

12th

18 Q

6th - 8th

23 Q

6th

10 Q

7th

12 Q

9th - 12th

27 Q

12th

21 Q

12th

17 Q

12th

10 Q

9th - 12th

22 Q

6th

7 Q

4th

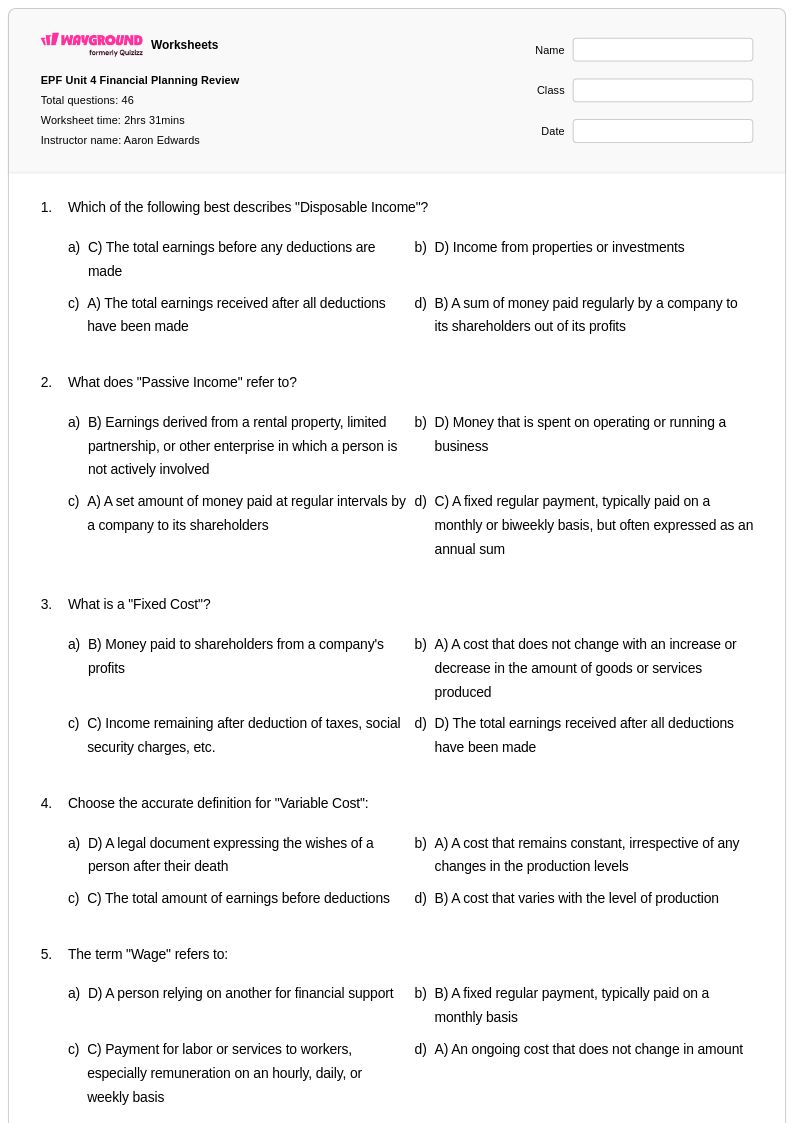

46 Q

12th

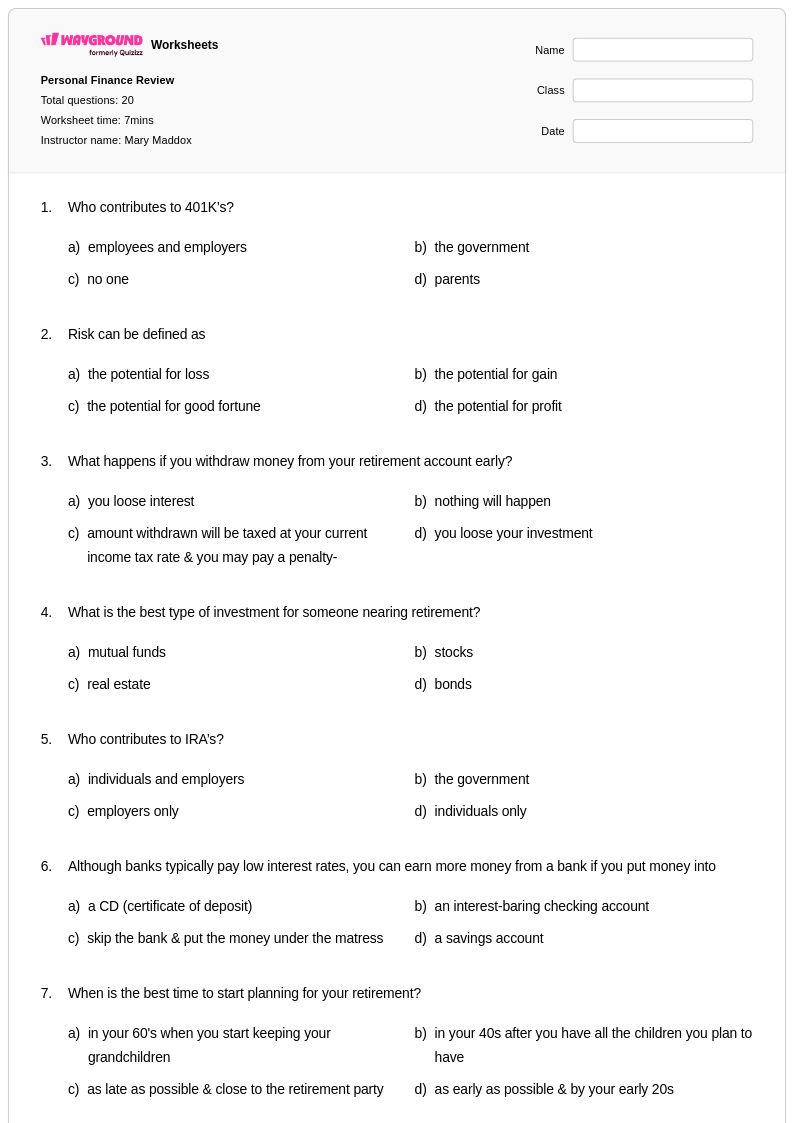

20 Q

12th

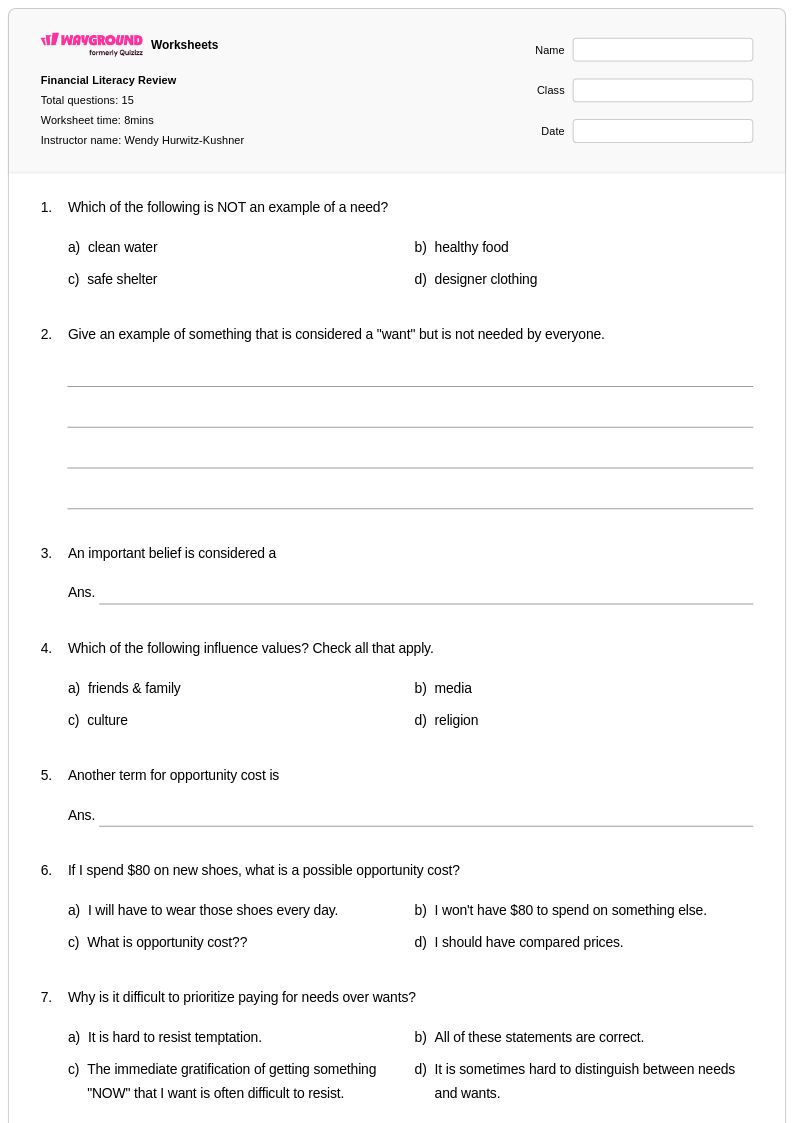

15 Q

5th - 7th

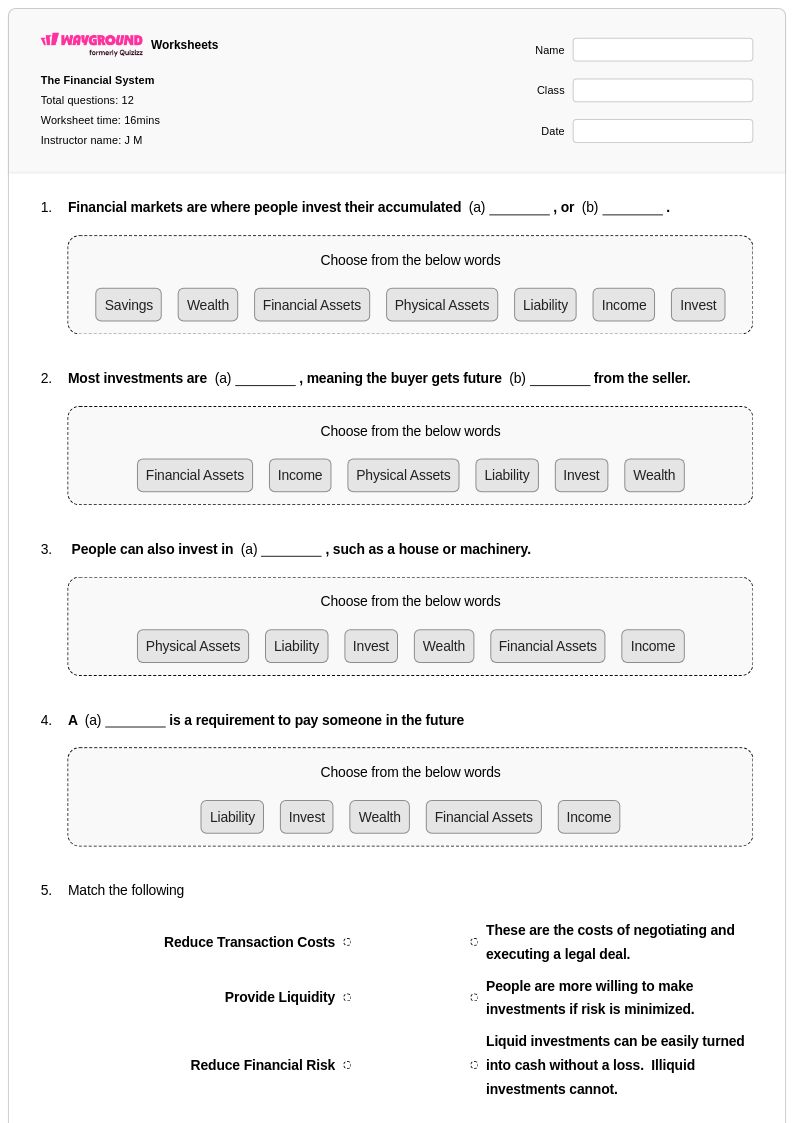

12 Q

12th

Explore Worksheets by Subjects

Explore printable Personal Financial Planning worksheets

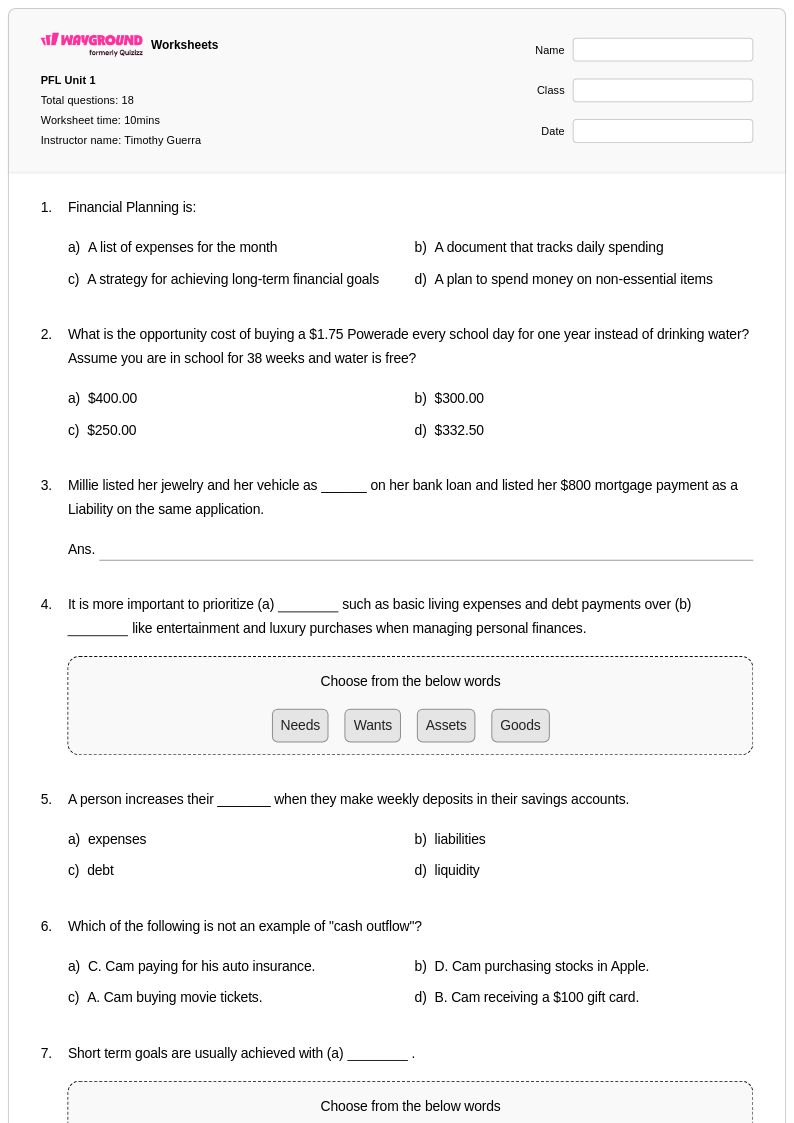

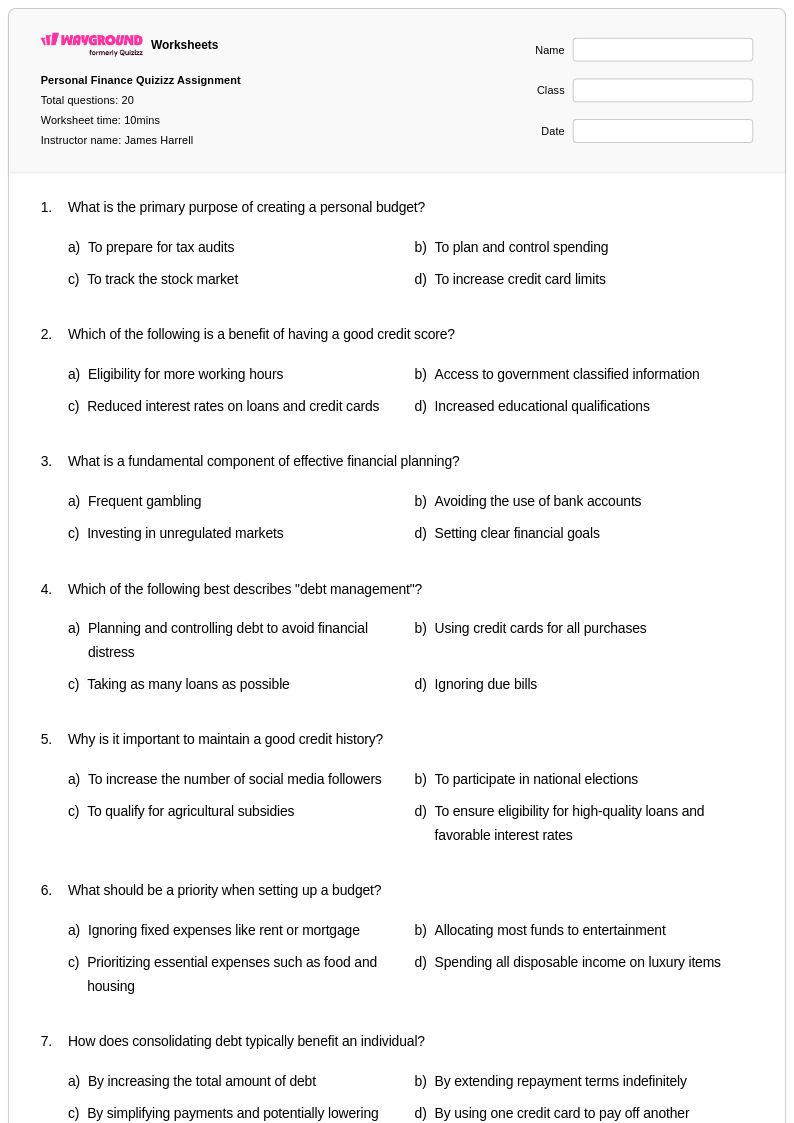

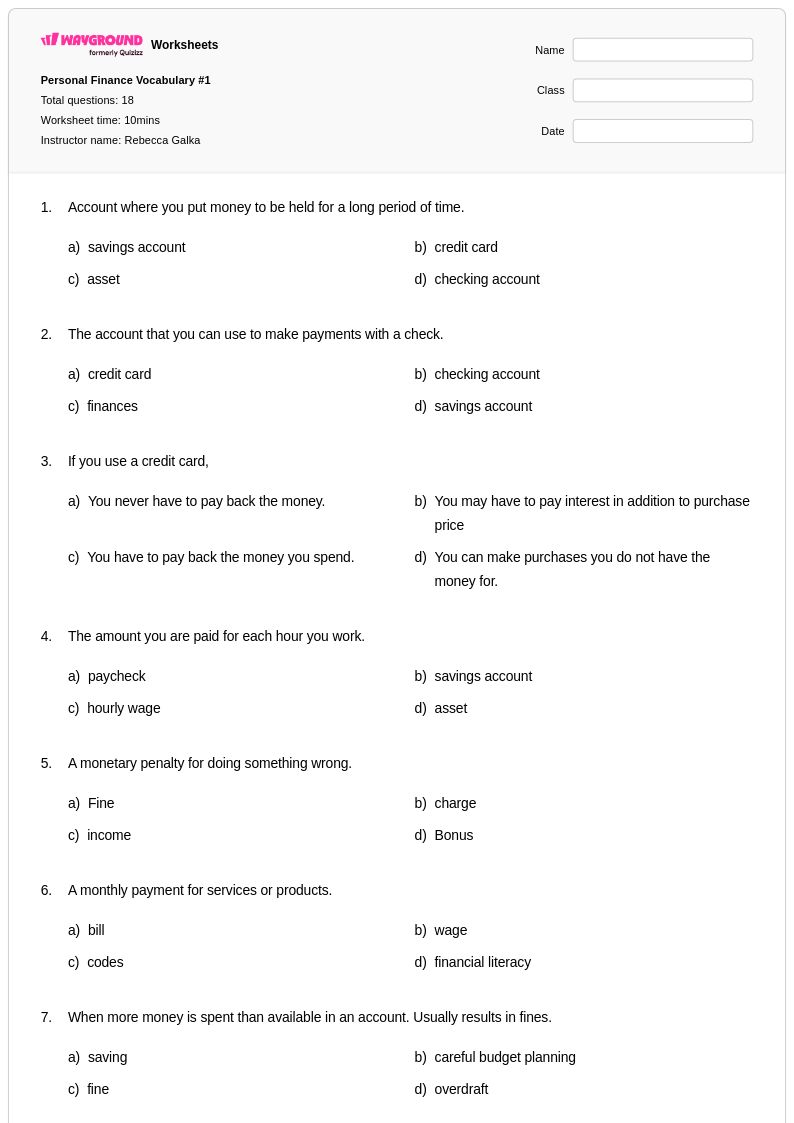

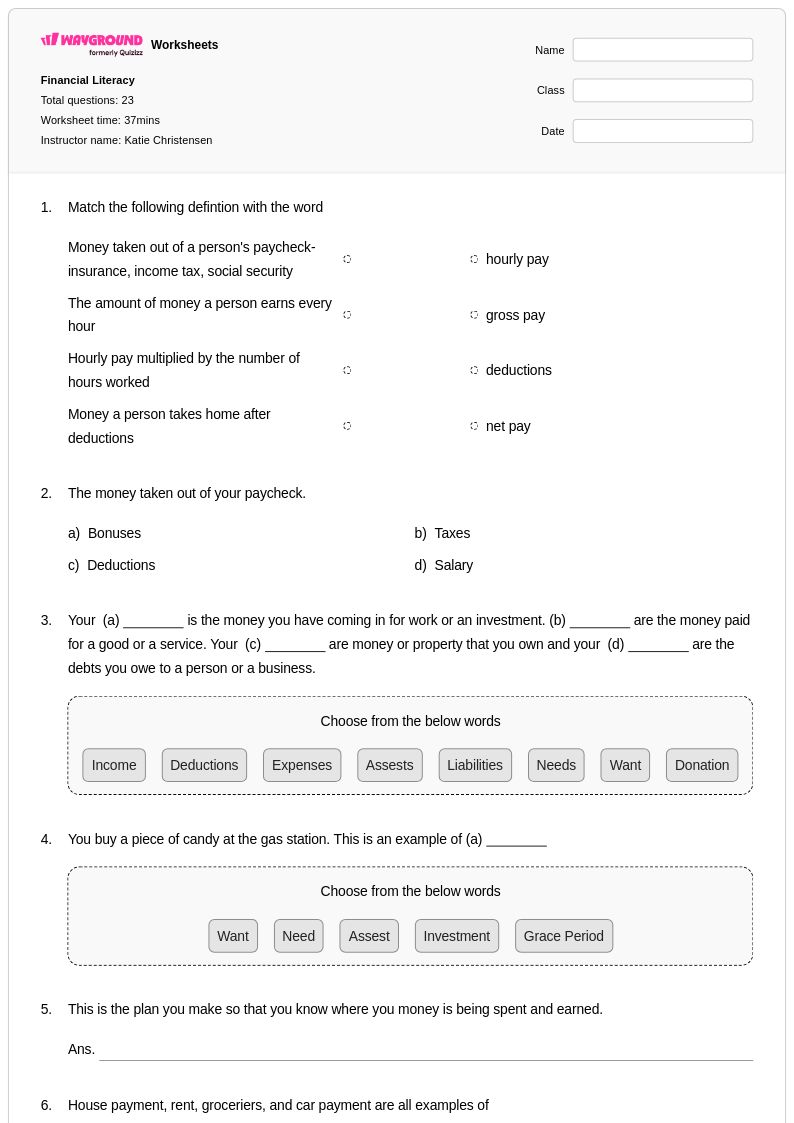

Personal financial planning worksheets available through Wayground (formerly Quizizz) provide students with essential hands-on experience in managing money, budgeting, and making informed financial decisions that will serve them throughout their lives. These comprehensive educational resources strengthen critical thinking skills around income management, expense tracking, savings goal setting, and understanding basic investment principles through realistic scenarios and practice problems. Students work through authentic situations involving creating monthly budgets, comparing banking options, calculating interest rates, and evaluating major purchases, with each worksheet including a detailed answer key to support independent learning. The free printable materials cover fundamental concepts such as distinguishing between needs and wants, understanding credit and debt, planning for emergencies, and setting long-term financial goals, making complex economic principles accessible through structured practice and real-world applications.

Wayground (formerly Quizizz) empowers educators with millions of teacher-created personal financial planning resources that seamlessly integrate into social studies curricula and support diverse learning needs across all grade levels. The platform's robust search and filtering capabilities allow teachers to quickly locate materials aligned with specific standards and learning objectives, while differentiation tools enable customization for students requiring remediation or enrichment in financial literacy concepts. These versatile worksheet collections are available in both printable pdf formats for traditional classroom use and digital formats for technology-enhanced learning environments, providing flexibility for various teaching situations. Teachers can efficiently plan comprehensive financial literacy units, address individual student needs through targeted skill practice, and assess understanding using materials that range from basic money management concepts to advanced topics like investment planning and retirement savings, ensuring students develop the financial competency essential for economic success.