18 Hỏi

7th

16 Hỏi

12th

16 Hỏi

9th - 12th

14 Hỏi

6th - 7th

8 Hỏi

12th

22 Hỏi

7th

44 Hỏi

7th - 12th

20 Hỏi

8th

10 Hỏi

7th

15 Hỏi

10th

17 Hỏi

7th

10 Hỏi

12th

15 Hỏi

8th

13 Hỏi

2nd

15 Hỏi

9th

18 Hỏi

6th - 8th

18 Hỏi

6th

11 Hỏi

12th

10 Hỏi

12th

10 Hỏi

8th

19 Hỏi

9th - 11th

25 Hỏi

12th

10 Hỏi

7th

38 Hỏi

12th

Khám phá bảng tính theo chủ đề

Explore printable Personal Finance worksheets

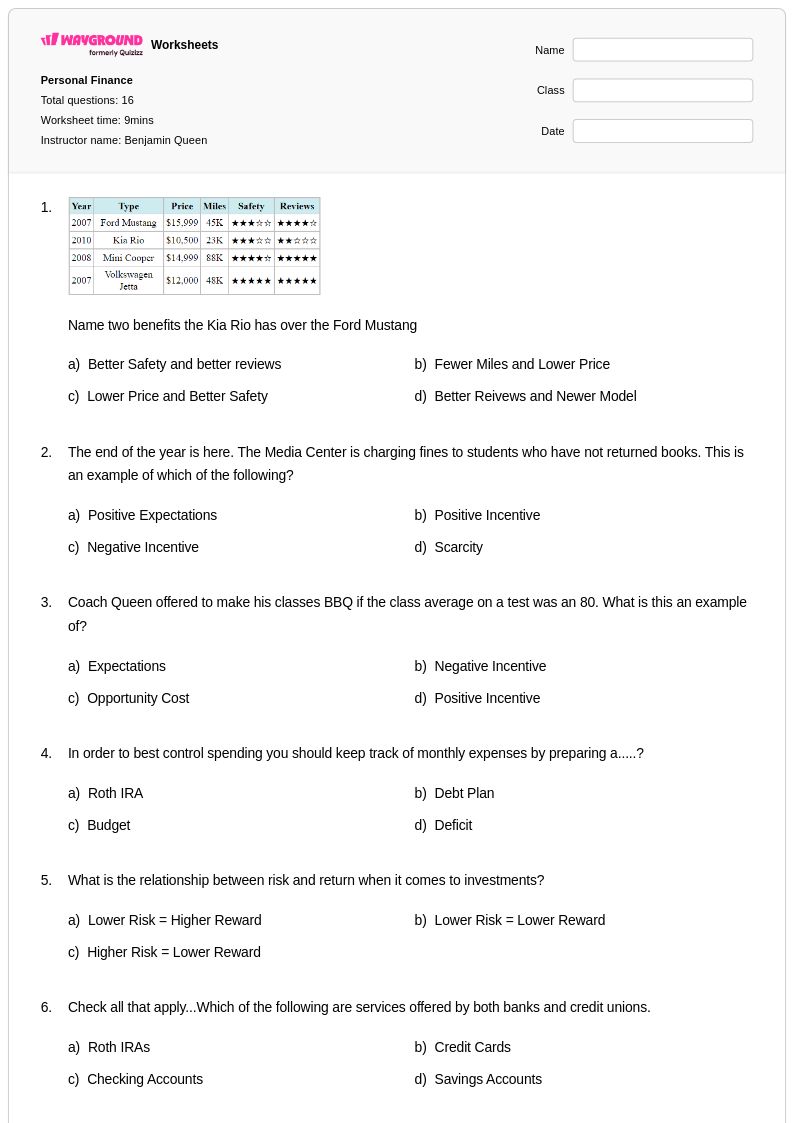

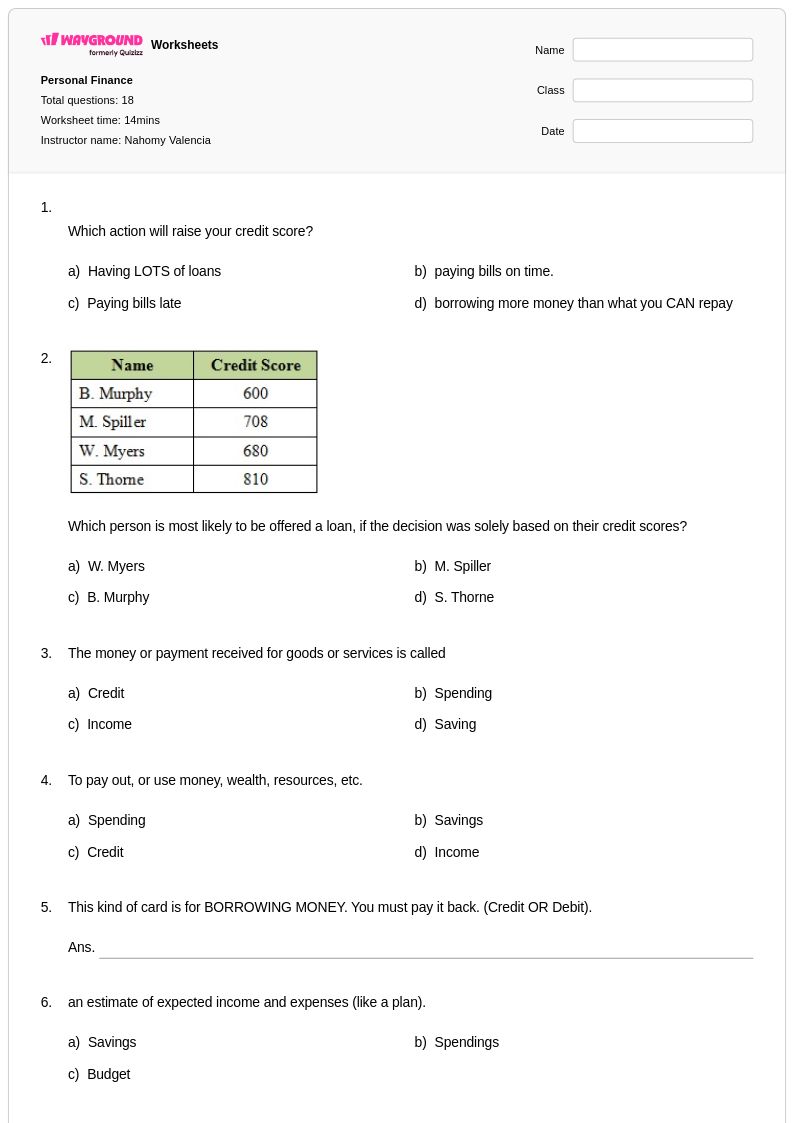

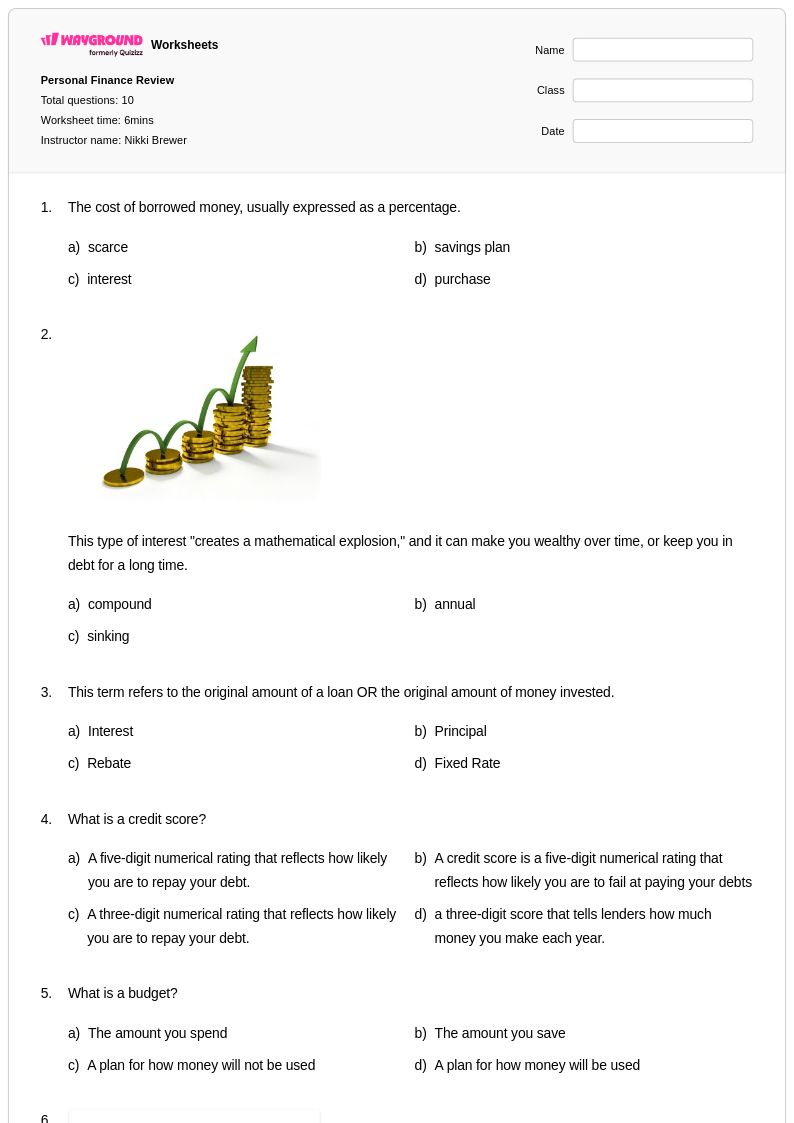

Personal finance worksheets available through Wayground (formerly Quizizz) provide comprehensive educational resources that help students develop essential money management skills and financial literacy competencies. These carefully crafted materials cover fundamental concepts including budgeting, saving strategies, understanding credit and debt, smart spending decisions, and basic investment principles that form the foundation of sound financial decision-making. Each worksheet collection includes detailed answer keys and practice problems designed to reinforce learning through hands-on application, while the free printable format ensures accessibility for diverse classroom environments. The pdf resources enable students to work through real-world scenarios involving income calculation, expense tracking, comparison shopping, and long-term financial planning, building critical thinking skills that will serve them throughout their lives.

Wayground (formerly Quizizz) empowers educators with an extensive library of millions of teacher-created personal finance resources that streamline lesson planning and enhance instructional effectiveness. The platform's robust search and filtering capabilities allow teachers to quickly locate materials that align with specific learning standards and educational objectives, while built-in differentiation tools enable customization for varied skill levels and learning needs. These versatile worksheet collections are available in both printable and digital formats, including convenient pdf downloads, making them adaptable for traditional classroom instruction, remote learning environments, or hybrid educational models. Teachers can leverage these comprehensive resources for targeted skill practice, remediation support for struggling learners, and enrichment opportunities for advanced students, ensuring that all learners develop the financial literacy competencies necessary for informed economic decision-making.